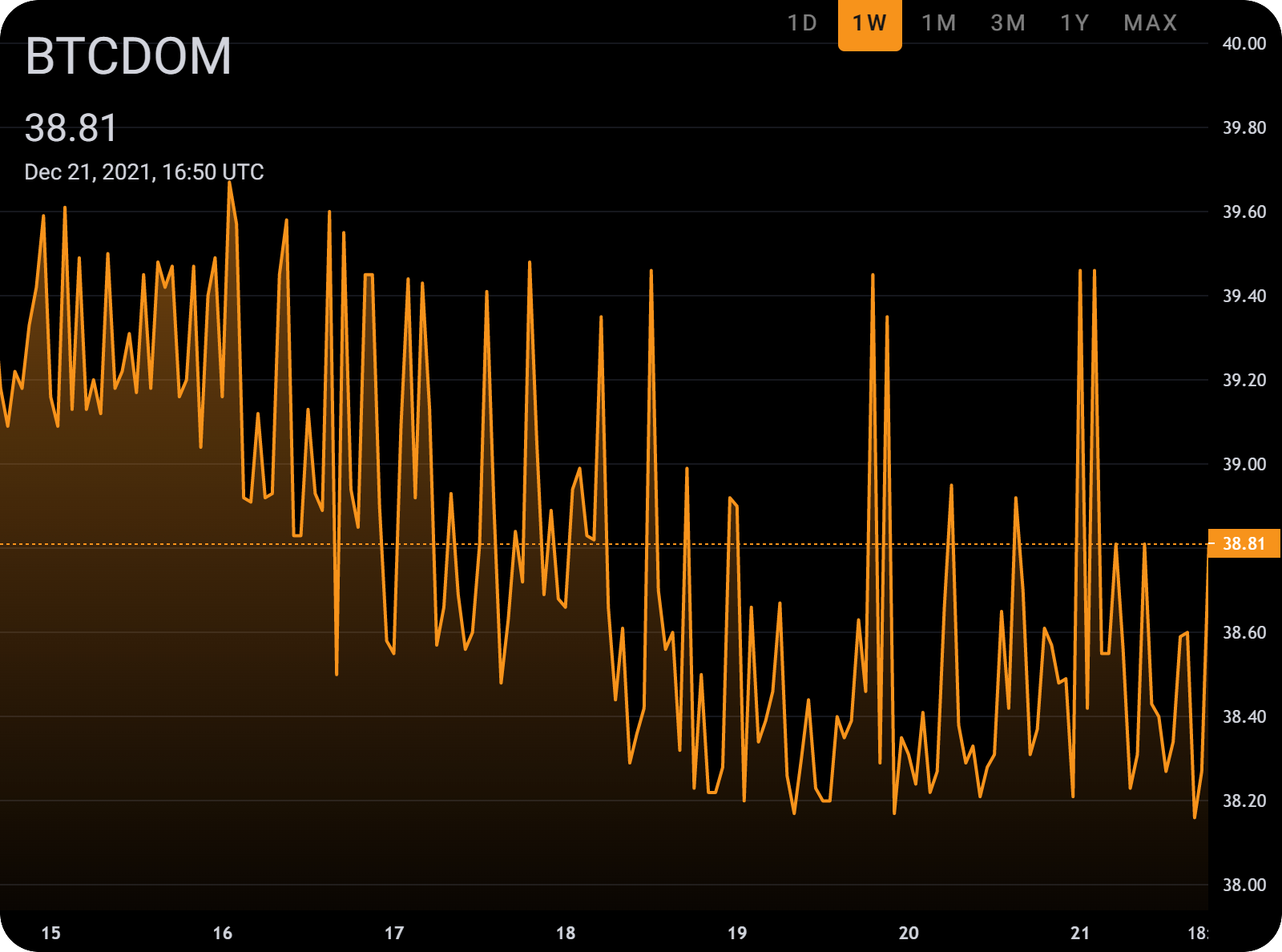

Dominance Debrief: 12/15 – 12/21

Bitcoin and Ethereum prices remained relatively flat this week, with minor losses across the board. Bitcoin held steady around the $46k mark, and Ethereum held around $3,900. Multiple factors may be contributing to this sentiment, including the anticipation of the U.S. central bank’s eventual decision to wind down its pandemic stimulus efforts as well as concerns about increased regulatory scrutiny of crypto.

As of last week, 90% of bitcoin’s total supply has already been mined, causing questions to arise about why prices have remained steady. With consumer prices continuing to rise and limited chance that inflation falls, discussion has grown about whether bitcoin can become the inflation hedge that many believe it to be.

“Bitcoin’s price movement over the next few months is going to be very telling about its use in the future as an inflation hedge,” says Adrian Kolody, co-founder of Domination Finance. “Prices have recently been reflecting movements in the TradFi market, which isn’t something we have seen too often.”