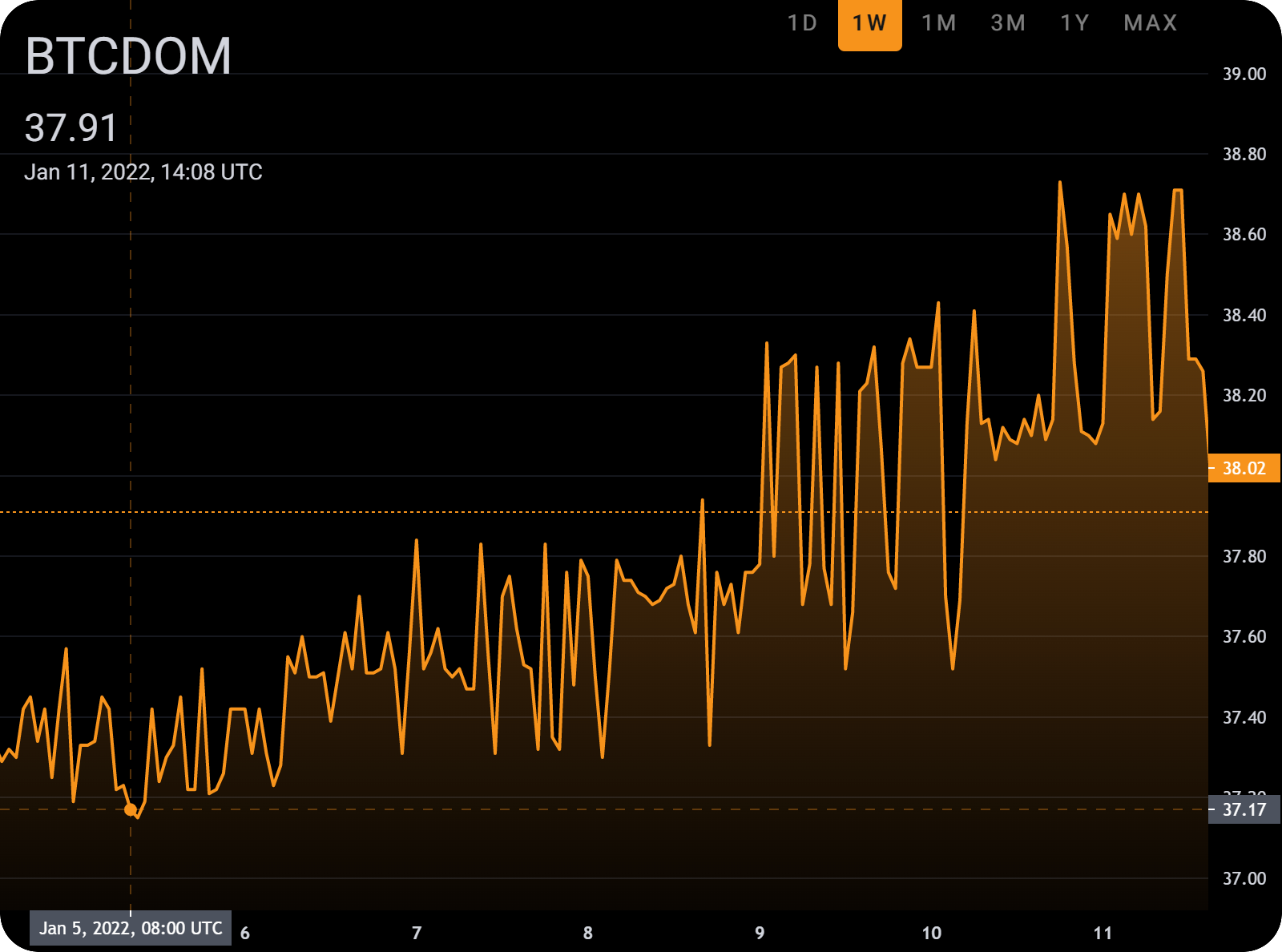

Dominance Debrief: 01/05 – 01/11

In yet another rough week for the crypto markets, the price of bitcoin continued to drop, briefly experiencing a flash crash below $40k on Monday. Ethereum was not spared from the fallout either, with its price declining beneath the $3k mark for the first time in three months.

One factor contributing to these price drops is that traders have been selling off their risk-on assets, such as growth stocks and cryptocurrencies, in anticipation of the Fed raising interest rates. The question that is up in the air is whether the market has now priced this factor in, or if further losses in value should be expected. Regardless, it is becoming increasingly clear that bitcoin’s days of 10x gains are coming to a close as the industry diversifies.

“Long-term, we’ll likely see a much more boring yet steady growth for bitcoin as the market matures and becomes more liquid,” co-founder Michal Cymbalisty told Capital.com this week. “The rest of the crypto ecosystem, with new layer-1s, layer-2s, and DeFi protocols being built, is thriving with innovation — this is where the high-risk, high-reward investment potential is shifting, especially as it now seems that bitcoin could ultimately become decoupled from the rest of the crypto markets.”