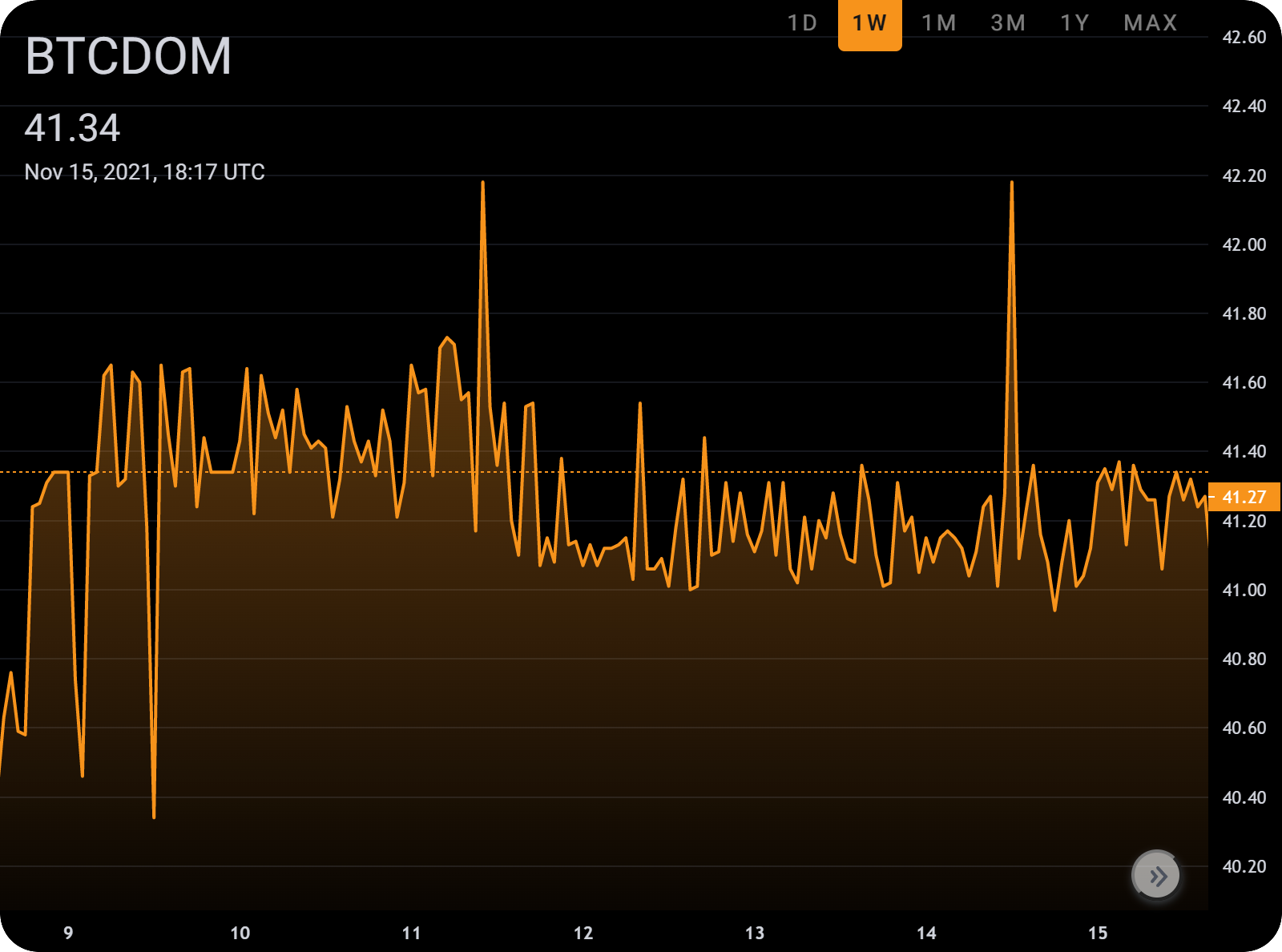

Dominance Debrief: 11/09 – 11/15

This past weekend was an important time for Bitcoin, with the network undergoing its first major update since 2017. The Taproot upgrade, which activated on Sunday, seeks to fundamentally improve the network’s privacy, security, and scalability, unlocking new opportunities for developers. In the wake of the highly anticipated upgrade, Monday night saw bitcoin’s price briefly dip below $59k as 24-hour crypto liquidations reached $875M.

Part of this stunning growth is being pushed by institutions, with an increasing number of ETF-style investments “What we’re seeing this week is a natural part of the up and down cycle of digital assets,” said Adrian Kolody, co-founder of Domination Finance. “Taproot didn’t have much of an impact on price in the short-term, but it is laying the long-term foundation for future innovation and investment potential.”

Bitcoin isn’t alone in its price pullbacks, with many of the highest market cap altcoins experiencing dips, including Ethereum. Nonetheless, the industry outlook on altcoins appears bullish, with Solana becoming the third crypto asset to have a dedicated Bloomberg-Galaxy index, a significant move for attracting institutional involvement.